Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Descrição

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

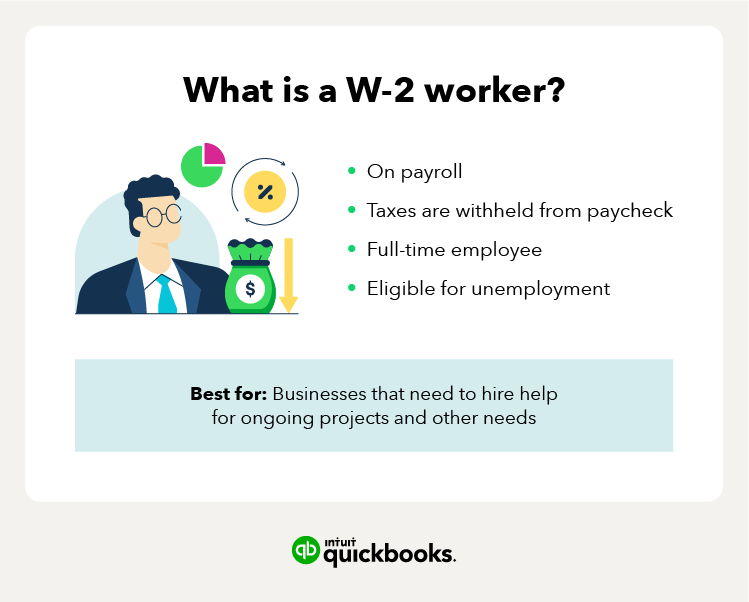

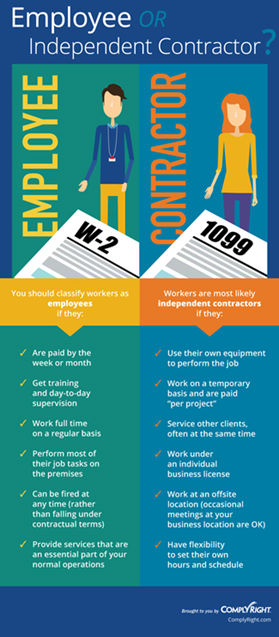

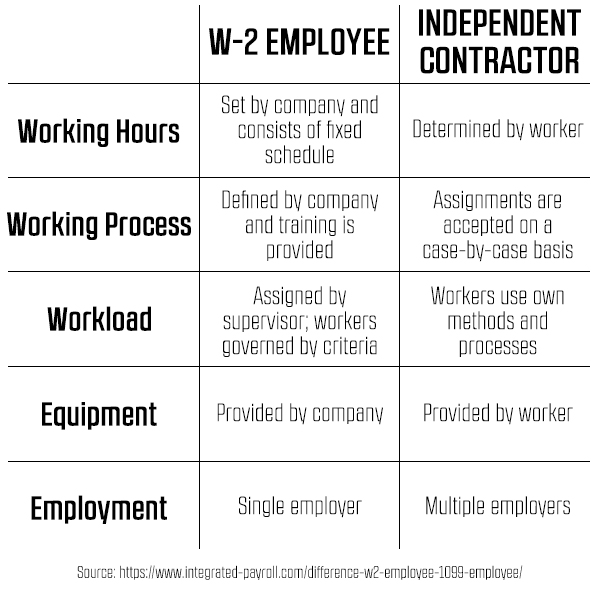

1099 vs W-2: What's the difference?

How To File And Pay Independent Contractor Taxes – Forbes Advisor

What is an Independent Contractor? Are They Employees?

:max_bytes(150000):strip_icc()/freelancer.aspfinal-735c7be9a7d642eabcafa5a0117e4823.jpg)

What Is a Freelancer: Examples, Taxes, Benefits, and Drawbacks

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Taxable Income: What It Is, What Counts, and How To Calculate

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

:max_bytes(150000):strip_icc()/form-1099-nec-nonemployee-compensation-definition-5181240-final-040005b7ae304574a63f6af389f9df5b.png)

What Are 10 Things You Should Know About 1099s?

Independent Contractor vs Employee: What's the Difference?

What can independent contractors deduct?

de

por adulto (o preço varia de acordo com o tamanho do grupo)